-

14+

Years of Experience

-

150+

Team Members

-

600+

Happy Clients

Your Reliable Partner in Custom Fintech Software Development In UK

Entrepreneurs can trust our fintech software development services in UK to deliver market-ready digital banking solutions. Our experts use modern tech stack to integrate technologies like AI and Blockchain with existing banking systems. We guarantee a precise development process for creating business-oriented payment solutions. With an experience of more than 14 years, we have developed multiple ewallet and peer-to-peer payment applications for businesses. As a leading fintech software development company in UK, our motive is to keep your business idea safe and confidential. We have experience in developing money lending platforms for all devices and operating systems.

Our online digital banking solutions offer fast payment, credit score checker, and AI-powered chatbot. So, banks and users can avail various financial services. We can transform your traditional systems into digitally smart fintech solutions. Get ready to experience a new domain with our fintech software development solutions in UK.

-

5+

Office Location

-

1000+

Projects Delivered

-

100%

Error-Free Work

Our Targeted Custom Fintech Software Development Services in UK

Our custom fintech app development company in UK provide multiple regularized services with reliable networks. We constantly focus to build intuitively, user-friendly, and feature-rich fintech app solutions. Our experts provide incredible fintech app development services in UK to support the business to achieve their targeted goals at reasonable rates.

-

Fintech Software Development Consultation

We offer expert fintech consultation services to help you define your digital strategy, select the right technologies, ensure regulatory compliance, and plan scalable solutions. Our inventive fintech software development company in UK guide you through risk analysis and market trends to launch future-ready fintech applications at reasonable prices.

-

Custom Fintech App Development Services

Our custom fintech app development services in UK delivers tailored solutions for banks, startups, and financial institutions. We build scalable, secure, and regulation-compliant apps with features like digital banking, AI analytics, and payment integrations. From idea to launch, we ensure your app meets unique business goals and customer expectations.

-

On-Demand Fintech App Development Services

We provide on-demand fintech app development services for on-time market entry and high scalability. It is ideal for startups and small businesses. Our team creates feature-rich and API-integrated financial apps like loan platforms, payment gateways and budgeting tools. We deliver speed, flexibility, and full compliance with UK legal agreements.

-

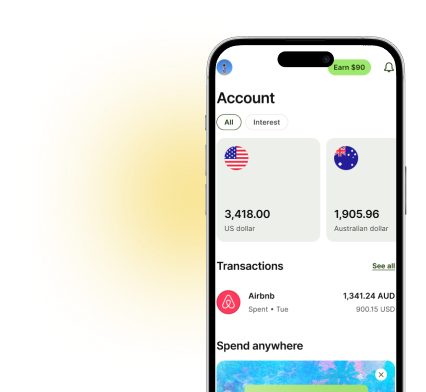

E-Wallet App Development Services

Our e-wallet development services create secure, user-friendly digital wallets for money transfers, bill payments, and contactless transactions. We fintech software development company in UK easily integrate multi-currency support and compliance features like KYC/AML. Empower your users with seamless mobile payment experiences, linked with encryption and real-time transaction tracking features.

-

Trading App Development Services

We are an innovative finance app development company who build advanced trading apps for live stocks, forex, and crypto markets with features like real-time market data, charting tools, AI-powered insights, and secure transactions. Our trading app development solutions are completely linked with UK financial regulations, delivering attractive interfaces and high-performance backend systems for retail or professional traders.

-

Fintech App Maintenance and Support Services

Ensure continuous performance and security with our fintech app maintenance and support services. We are a custom fintech software development company in UK that provides regular updates, bug fixes, scalability enhancements, and compliance audits. Our dedicated mobile app developers in UK monitors system performance, ensuring your app remains fast, secure, and competitive.

Looking for a Profitable Banking App Solution in UK?

Invest in software development for fintech solutions that meets modern customer demands. From seamless banking to online trading, we create market-ready solutions to drive your business forward. Hurry Now to Start Early!

Inspiring Success Stories

Explore innovation and creativity by reviewing our portfolio and work performance. Know our transformation process to get seamless, scalable, high-performing mobile banking applications!

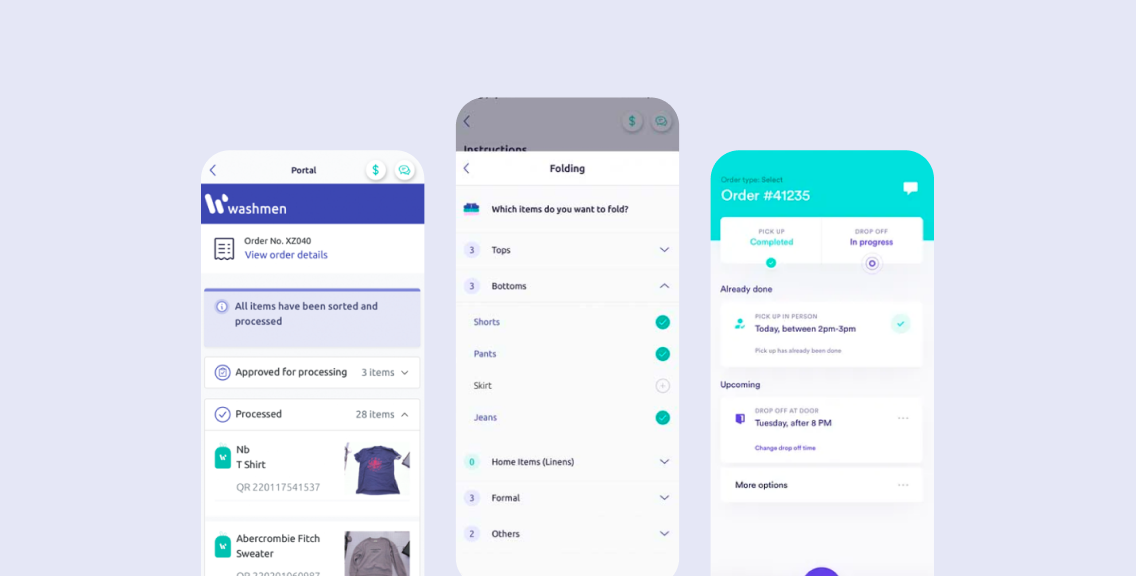

WASHMEN

WASHMEN is an on-demand laundry and dry-cleaning app designed to simplify and streamline the laundry service experience. Catering to busy individuals and professionals, WASHMEN provides hassle-free pick-up, cleaning, and delivery services with just a few taps.

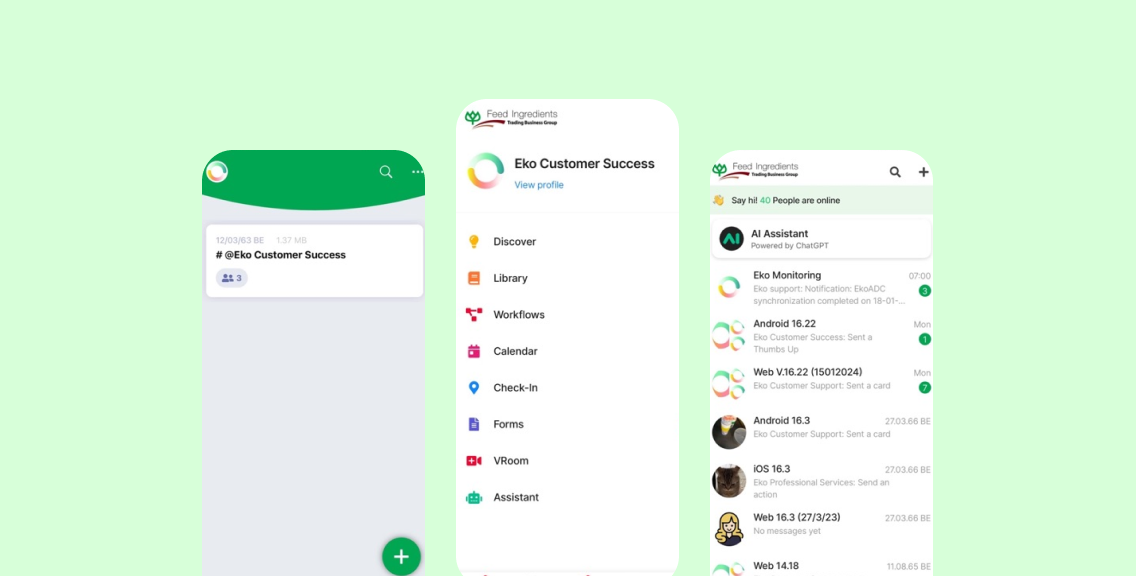

FitConnect

FitConnect is an innovative SaaS-based platform designed for virtual fitness classes, targeting gyms, fitness studios, and freelance coaches. It provides an engaging and accessible solution for fitness professionals and enthusiasts, enabling them to connect seamlessly.

Healthcare Web Application Allevia

Project Overview Allevia™ is a mobile-optimized and cloud-based application that plugs right into your current EHR and patient portal. As soon as an appointment is scheduled within the EHR, patients receive a text message, email, and/or portal notification.

Exciting Features of Fintech Apps!

We are a renowned fintech software development company in Wales helping entrepreneurs to make exclusive banking solutions with interactive features. This streamlines money transfer, revenue growth, and business success.

Secure Account Registration & Login

Users can sign up using email, phone, or biometric authentication, ensuring secure access with multi-factor authentication (MFA).

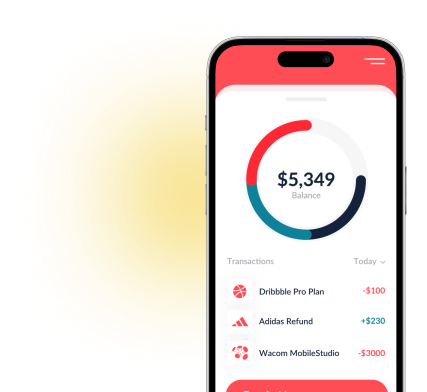

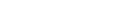

Real-Time Transactions & Payments

Enables instant fund transfers, bill payments, and QR code transactions with encrypted security measures.

AI-Powered Financial Insights

Provides personalized expense tracking, budgeting tools, and financial recommendations based on user spending patterns.

Multi-Currency & Cryptocurrency Support

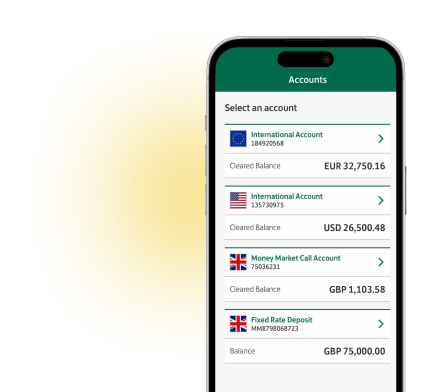

Allows users to hold, exchange, and transfer fiat or crypto assets with real-time exchange rates.

Open Banking API Integration

Secure API connections enable instant bank account linking, transaction history access, and seamless payments.

Fraud Detection & Risk Management

AI-powered fraud detection monitors suspicious activities, prevents fraud, and ensures regulatory compliance.

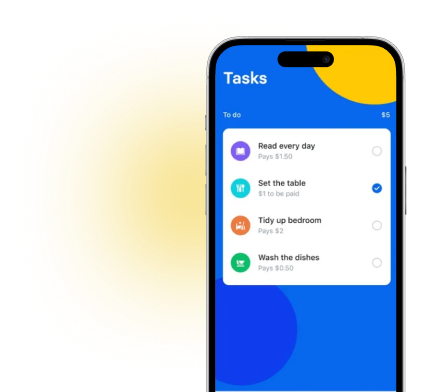

Loan & Credit Processing

Automates loan applications, credit score assessments, and approval workflows for quick financial decisions.

KYC & AML Verification

Ensures compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations through document verification and background checks.

User Management & Access Control

Admins can manage user profiles, permissions, and security settings to maintain platform integrity.

Transaction Monitoring & Analytics

Provides detailed reports, transaction tracking, and fraud detection alerts to improve operational efficiency.

Regulatory Compliance Dashboard

Automates compliance checks for GDPR, PSD2, FCA regulations, and financial audits in real time.

Revenue & Commission Management

Tracks service fees, commissions, and revenue insights to optimize financial performance.

Our Incredible Fintech Software Development Solutions

Our custom fintech mobile app development company in UK provides advanced and adaptable solutions for digital banking and money transfer for various business objectives. We assist clients to become a leader in the fintech industry with cutting-edge technology and designs focused on users.

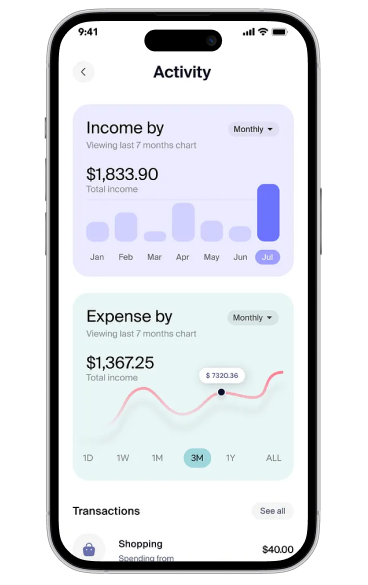

Budgeting Software Development

Our fintech software development solutions help individuals and businesses track expenses, set financial goals, and optimize savings. We are a professional fintech solutions software development company that integrates AI-driven analytics and automated financial planning tools. Ensure secure bank integrations, Open Banking compliance, and multi-device accessibility, to make financial management effortless. Our fintech app development solutions empower businesses with a user-friendly interface.

Neobank Development Solution

We build next-generation neobank solutions that offer a seamless digital banking experience without traditional branch visits. Our neobank platforms feature secure digital account management, instant fund transfers, AI-driven financial assistance, and Open Banking API integrations. With built-in KYC/AML verification, card issuance, and personalized financial tools, we ensure compliance with FCA regulations in the UK. Our solutions help fintech startups and financial institutions with a fast and user-centric experience.

RegTech Solution

Our RegTech solutions help financial institutions and fintech companies ensure compliance with evolving regulations. We develop AI-powered fraud detection, AML/KYC automation, risk assessment tools, and data encryption solutions to mitigate regulatory risks. Our platforms provide real-time compliance monitoring, automated reporting, and secure integrations with financial data sources. We are the best fintech app development company in Scotland who can streamline compliance processes and reduce operational costs.

Credit App Development Solution

We offer custom credit development solutions that simplify lending processes for banks, credit unions, and fintech startups. Our platforms feature AI-powered credit scoring, loan origination systems, real-time risk assessment, and automated approvals to provide fast and secure lending services. Our credit software integrates with Open Banking APIs, alternative data sources, and regulatory frameworks, ensuring compliance with UK lending laws. We optimize credit accessibility and user experience for BNPL and enterprise lending.

Investment App Development

Our investment app development services empower users with AI-driven stock recommendations, real-time market data, and crypto trading. We integrate secure payment gateways and personalized investment insights to create next-gen fintech apps. Our solutions ensure FCA compliance, multi-asset support, and seamless integrations with global trading platforms. Whether for retail investors, asset managers, or fintech startups, we build secure and intuitive apps that enhance wealth-building opportunities.

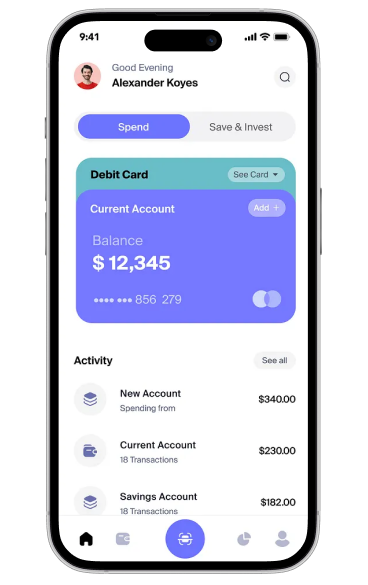

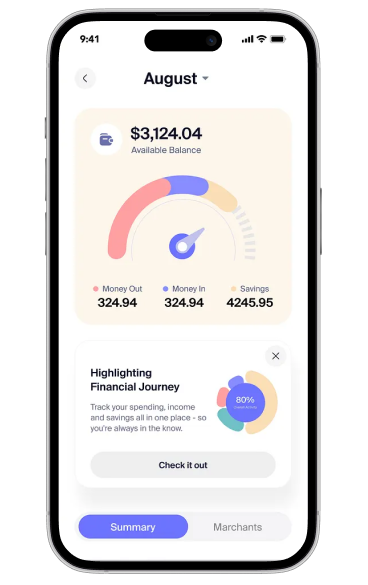

Digital Banking Solution

We develop scalable, secure, and user-friendly digital banking solutions that provide seamless account management, instant payments, P2P transfers, AI-driven financial insights, and fraud detection. Our financial software development company provides solutions that support multi-currency transactions, biometric authentication, and card management to enhance financial accessibility. Our digital banking solutions prioritize security, scalability, and legal regulations.

Benefits of Investing in Custom Fintech Software Development in UK

Investment of money in fintech app development provides numerous market and technical benefits to businesses. It helps in transforming the existing domain into new opportunities:

-

AI Automation

Custom fintech software leverages AI-driven automation to enhance fraud detection, automate transactions, and improve customer service through chatbots and predictive analytics. This reduces the fintech software development cost and minimizes human errors.

-

Seamless Digital Banking

Investing in custom fintech software ensures a smooth and user-friendly digital banking experience with real-time transactions. Customers benefit from secure and instant payments while financial institutions enhance efficiency.

-

Secure Blockchain Solutions

Various blockchain solutions provide decentralized transactions and transparent financial operations. Blockchain-powered fintech software enhances security and reduces transaction costs through smart contracts and or fraud prevention.

-

Fast Loan Processing

AI-powered loan applications automates credit scoring, risk assessment, and loan approvals, reducing processing time. Secure banking integration and real-time verification allow users to borrow easily.

-

Enhanced Personalization

Big data analytics and AI-driven insights offer personalized financial products, investment recommendations, and money suggestions. By understanding customer behavior, you can boost user engagement and satisfaction.

-

Constant Revenue Growth

Businesses can increase revenue through transaction fees, subscription models, and value-added services. AI-driven automation ensures long-term financial stability and growth for fintech startups and financial institutions in the UK market.

Get Ready to Build an Online Mobile Bank App?

Build a customized finance and banking app by connecting with our fintech software development company in UK. Improve customer satisfaction, increase growth, and get market access to reach at a global level.

Business Consultant

Our professional business consultants will connect with you shortly after you submit your requirements and help turn your idea into reality.

Cutting-Edge Technologies for Fintech App Development in UK

-

AI-Powered Fintech App Solutions

AI enhances fintech applications by automating risk assessment, fraud detection, and customer support through predictive analytics and chatbots. AI-driven algorithms personalize financial insights, optimize investment strategies, and streamline banking operations. Fintech startups can hire fintech software developers to ensure seamless and data-driven decision-making.

-

Blockchain for Secure Transactions

Blockchain technology ensures decentralization and transparency in financial transactions. Smart contracts enable automated agreements, while crypto payments and tokenization enhance security. Top fintech software development companies in UK use blockchain for secure identity verification and fraud-resistant digital payments, ensuring regulatory compliance and trust.

-

Robo-Advisors for Asset Management

Robo-advisors use AI and machine learning to offer automated and affordable investment management. These digital financial advisors analyze risk preferences, optimize portfolios, and provide real-time financial insights. Many fintech web development companies in London leverage robo-advisors to deliver personalized wealth management solutions helping users and businesses.

-

Embedded Finance for Financial Services

Embedded finance integrates financial services like payments, lending, and insurance into non-financial platforms. Use of financial software development services can offer seamless financial transactions, credit options, and insurance with proven financing solutions. We are among the best fintech app development companies that build banking software by integrating embedded finance to enhance customer experiences and explore new revenue streams.

Fintech App Clone Development

We provide qualified fintech app development solutions in UK to target different financial issues. Our developers focus on building clones of best industry leaders to implement similar features with a new business model.

Revolut

Our Revolut clone solution offers real-time payment services and effective money tracking options to users. We are a reputed banking software development company that guarantees complete assistance through upgraded financial services.

Lloyds Mobile Banking

A Lloyds Mobile Banking app clone helps users to easily send digital currencies with a 100% accuracy rate. Additionally, it is easy to save money on the app with the help of an e-wallet feature.

Monzo

We build Monzo clone apps to streamline the transaction process. Our incredible fintech software development company in Ireland helps businesses to build highly interactive Neobank solutions that guarantee data security.

Wise

Our experienced banking app developers integrate online trading, currency conversion, and mobile wallet features in Wise app clones. This reduces the fintech app development cost and provides a reliable solution at affordable rates.

Powering Next-Gen Fintech Software with Robust Technology

To make certified fintech solutions, we use an incredibly chosen tech stack that provides comfort and ease for development. We are a professional fintech software development company in Scotland having experience with advanced tools and technologies. Our dedicated developers are known for developing top-notch mobile payment apps like eToro and Revolut with unique technologies.

Reliable Fintech Software Maintenance & Support for High Productivity

Businesses can get assured maintenance and support services by connecting our trustworthy experts. We are a leading fintech software development company in England ensuring security patches, bug testing, and performance optimization. This reduces the fintech software development cost and increases overall efficiency of fintech apps by guaranteeing an errorless model.

-

Bug Fixes & Issue Resolution

Debugging process to remove consistent errors.

-

App Performance Optimization

Reduce overloading and increase processor speed.

-

Security Updates & Patches

Using encrypted algorithms for security and updates.

-

Feature Enhancements & Upgrades

Enhancing registered features and targeting unique ones.

-

Server Monitoring & Maintenance

Regularly monitor digital wellbeing of mobile apps.

-

OS & Device Compatibility Updates

Making compatible platforms for different OS and devices.

Our Streamline Fintech Software Development Process

At Dev Technosys, entrepreneurs can experience a suitable finance mobile app development process. We guide our clients to build market-ready banking payment solutions successfully. Our experts use advanced tools and technologies to integrate seamless payment options, AI-powered chat assistance, and interactive designs. We ensure complete maintenance and security support.

Requirement Gathering & Analysis

Initially, we connect with our clients to know their needs, demands, and find target audiences. Our experts help entrepreneurs to make desired plans and execute them with high efficiency.

UI/UX Design

Different panels for users and bank service providers are designed to deliver targeted features. It includes request management and status approval for banks, rewards and money transferring for users.

Backend Development

Our ewallet app developers implement databases, APIs, and Node frameworks to establish a connection between user and server. This guarantees high accessibility and availability of user data.

Testing & Quality Assurance

We ensure proper testing and security of digital banking solutions. Our QA team is experienced in performing bug testing and beta testing tasks. This removes the risk of platform vulnerabilities.

Deployment

Entrepreneurs can easily launch finance and banking platforms in different formats like a mobile app or a website. We assist our clients to provide instant access to users for service feedback.

Post-Launch Support & Maintenance

Our fintech software development services in UK includes maintenance of financial mobile apps. We help businesses to easily find out updates and security issues and get solutions instantly.

Why Choose Us?

We deliver cutting-edge fintech app development solutions in UK that help our clients to maintain user trust and gain profit.

Who We Are

Our community is suitable for all levels of entrepreneurs. We are a leading fintech software development company in UK who elevate the performance to reach desired success.

14+

Years of Experience

150+

Team Members

600+

Happy Clients

1000+

Projects Delivered

What Drives Us?

Our high interoperability is our main driving force. We help our clients to increase their brand value by targeting multiple market opportunities with innovative digital transformation.

Our Achievements & Certifications

Top IT Services Company

Top Mobile App Development Firm

Leading Software Development Agency

Award-Winning Web & Mobile Solutions

Hire Dedicated Fintech Software Developers for Digital Payment Solutions

Do you want a market-ready mobile banking solution? We are an experienced fintech software development company in UK that provides skilled experts. Our developers specialize in developing fast and secure fintech apps with highly interactive features.

Custom Development

Hire fintech app developers to build creative and interactive digital payment solutions with customized features. Our experts can deliver user-specific solutions and modify existing systems to improve their experience.

On-Demand Hiring

On-demand fintech software developers provide instant solutions based on the business requirements. Entrepreneurs can make desired integration in ewallet apps by contacting our experts at reasonable prices.

Full-Time Engagement

We are a professional fintech software development company in UK providing full-time developers to build a fintech app from scratch. Our experts also provide continuous maintenance after the development process.

Frequently Asked Questions

Which Fintech Apps are Popular in the UK?

In the UK, there are multiple finance and banking applications available for users. Revolut, Monzo, Wise, and Starlink Bank are some of the finest platforms that are active in different UK regions.

What is the Cost to Develop a Fintech App Like Lloyds Mobile Banking?

The average fintech app development cost in UK ranges between £7,600 and £22,300. It is dependent on various market factors like feature complexity, experience level, and technical stack. The cost to develop a fintech app like Lloyds Mobile Banking is increased due to these factors.

How Long Does it Take to Build a Fintech Application in UK?

The development timeline ranges between 3 to 6 months depending upon the requirements. It may increase due to additional features and a complex development process. The time to develop fintech software is also dependent on testing and security of the app that ensure safe money transfers.

How Much Does it Cost to Maintain Fintech Software?

The maintenance cost ranges between 15-20% of the total development cost. Various factors like security, updates, and optimization affect the maintenance rate. For an investment of £15,000 the cost to maintain banking apps is between £2,200 and £3,000.

What is the Cost to Hire Fintech Developers in UK?

The cost to hire banking app developers is dependent on several factors like hiring model and experience level. A junior developer in London may charge between £5-£15, but for a senior developer, the rate may increase to more than £40.

What Types of Fintech Solutions do you Develop?

We develop custom fintech solutions including digital banking apps, payment gateways, trading platforms, lending software,and RegTech solutions. Our blockchain-based fintech apps, and AI-powered financial tools, ensure security, compliance, and seamless user experience.

How do you Ensure Compliance with UK Financial Regulations?

Our fintech solutions follow FCA regulations, PSD2, GDPR, Open Banking standards, and KYC/AML compliance. It helps businesses to meet legal and security requirements, ensuring safe financial transactions and data privacy.

Do You Offer AI-Driven Fintech Solutions?

Yes! We integrate AI and machine learning into fintech software for automated fraud detection, personalized financial insights, robo-advisors, chatbots, risk assessment, and predictive analytics to enhance financial decision-making.

Can you Develop Blockchain-Based Fintech Applications?

We specialize in blockchain-powered fintech apps for secure transactions, smart contracts, cryptocurrency exchanges, tokenization, and decentralized finance (DeFi) solutions. This ensures transparent and security-proven financial operations.

Do you Provide Fintech API Development and Integration?

Yes, we develop custom APIs and integrate services with open banking systems, payment gateways, trading platforms, and financial data providers. This enables seamless, secure transactions and real-time data access.

How do you Ensure the Security of Fintech Applications?

We implement end-to-end encryption, biometric authentication, multi-factor security, AI fraud detection, and blockchain security. Our ewallet app developers protect sensitive financial data and prevent cyber threats.

Do you Offer Post-Launch Fintech App Maintenance and Support?

Yes, we provide ongoing maintenance, security updates, feature enhancements, and 24/7 support. This ensures fintech apps remain secure, scalable, and updated with modern financial regulations and market trends.

How do you Ensure the Security of financial Transactions in Fintech Apps?

We use end-to-end encryption, multi-factor authentication (MFA), biometric security, and AI-powered fraud detection to secure financial transactions. Our solutions comply with FCA, PSD2, and GDPR regulations, ensuring safe and seamless payments.

What Measures do you Take to Protect User Data?

Our fintech solutions incorporate data encryption, tokenization, secure cloud storage, and GDPR-compliant data handling to protect sensitive user information. We also implement role-based access controls (RBAC) and continuous security monitoring to prevent unauthorized access.

Do you Comply With UK Financial and Data Protection Regulations?

Yes, we strictly adhere to various financial regulations like Financial Conduct Authority (FCA), GDPR, PSD2, and Open Banking security standards. Our privacy approach ensures that all fintech applications meet legal and security requirements in the UK market.

What Our Clients Say

Have questions related to Software Engineering and IT Outsourcing? We have tried to address some of the common concerns of our clients.

Dev Technosys transformed our idea into a seamless mobile app. Their expertise and dedication ensured a flawless user experience. Highly recommend for professional app development!

CEO at TechNova Solutions

Our website redesign by Dev Technosys exceeded expectations! The team delivered a modern, responsive site that boosted engagement and conversions. Professionalism at its best!

Marketing Head at Bright Innovations

Their fintech app development expertise is unmatched. Dev Technosys built a secure, scalable solution that streamlined our financial services. Exceptional quality and support!

Founder at FinTechPro

Our latest blogs

-

Personal Growth 5 Uses of Artificial Intelligence that will blow your mind

Gabriel20 - July 2021 -

Personal Growth 5 Uses of Artificial Intelligence that will blow your mind

Gabriel20 - July 2021 -

Personal Growth 5 Uses of Artificial Intelligence that will blow your mind

Gabriel20 - July 2021

Discuss Your Project and Request for Proposal

Convert your idea into a digital product with top developers

Share your idea or requirement with our experts.

We’re prompt and available for your needs globally, with strong roots in North America, the APAC region, Canada, and the Middle East.

+91 99832 63662

+91 99832 63662  live:devtechnosys

live:devtechnosys